First Security Islami Bank PLC SWIFT Code for Global Transfers

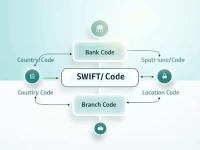

This article provides detailed information about the SWIFT/BIC code FSEBBDDHAGR for FIRST SECURITY ISLAMI BANK PLC in Bangladesh. It emphasizes the importance of accurately using this code in international remittances, helping users avoid errors and delays during the transfer process, and ensuring that funds reach the intended account smoothly.